CBN, Partners host 2nd IFIC; unveil We-Fi Code, WFID, roadmap for FDPs

Central Bank of Nigeria (CBN) Governor, Mr. Olayemi Cardoso has reaffirmed that inclusive finance is not just about access to banking—it is the bedrock for #EconomicGrowth in Nigeria.

Cardoso restated this at the 2nd International Financial Inclusion Conference (IFIC) in Lagos on Tuesday.

He craved for Bank’s unwavering commitment to financial inclusion, just as he pledged to reduce barriers and make finance accessible to all.

“By reaching the unbanked, we are building a resilient, $1 trillion economy.

“Financial inclusion is not just a goal; it is key to poverty reduction, income equality, and economic growth. For Nigeria, this means empowering citizens to save, invest, and thrive economically.

“Women are essential to Nigeria’s economic growth, yet they face financial exclusion. When women thrive financially, they uplift families and communities. The CBN is committed to closing this gap, offering support for women and youth to achieve financial independence and drive economic growth,” Cardoso assured.

Nigeria is advancing in financial inclusion through resilient policies, digital solutions, and financial literacy programmes that empower young Nigerians to achieve financial independence, foster entrepreneurship, and drive growth. Let us invest in the next generation!

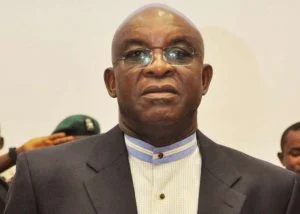

In a similar vein, CBN Deputy Governor, Financial System Stability (FSS), Mr. Phillip Ikeazor, called for greater teamwork across government, private sector, FinTech, and civil society to achieve the goal of 95% financial inclusion by 2024.

“Nigeria’s commitment to the #MayaDeclaration has driven progress in financial access. Since our 2012 National Financial Inclusion Strategy, the adult exclusion rate dropped from 46.3% in 2010 to 26% in 2023. A collaborative journey!”